IRS Forms 1098-T - Tuition Statement

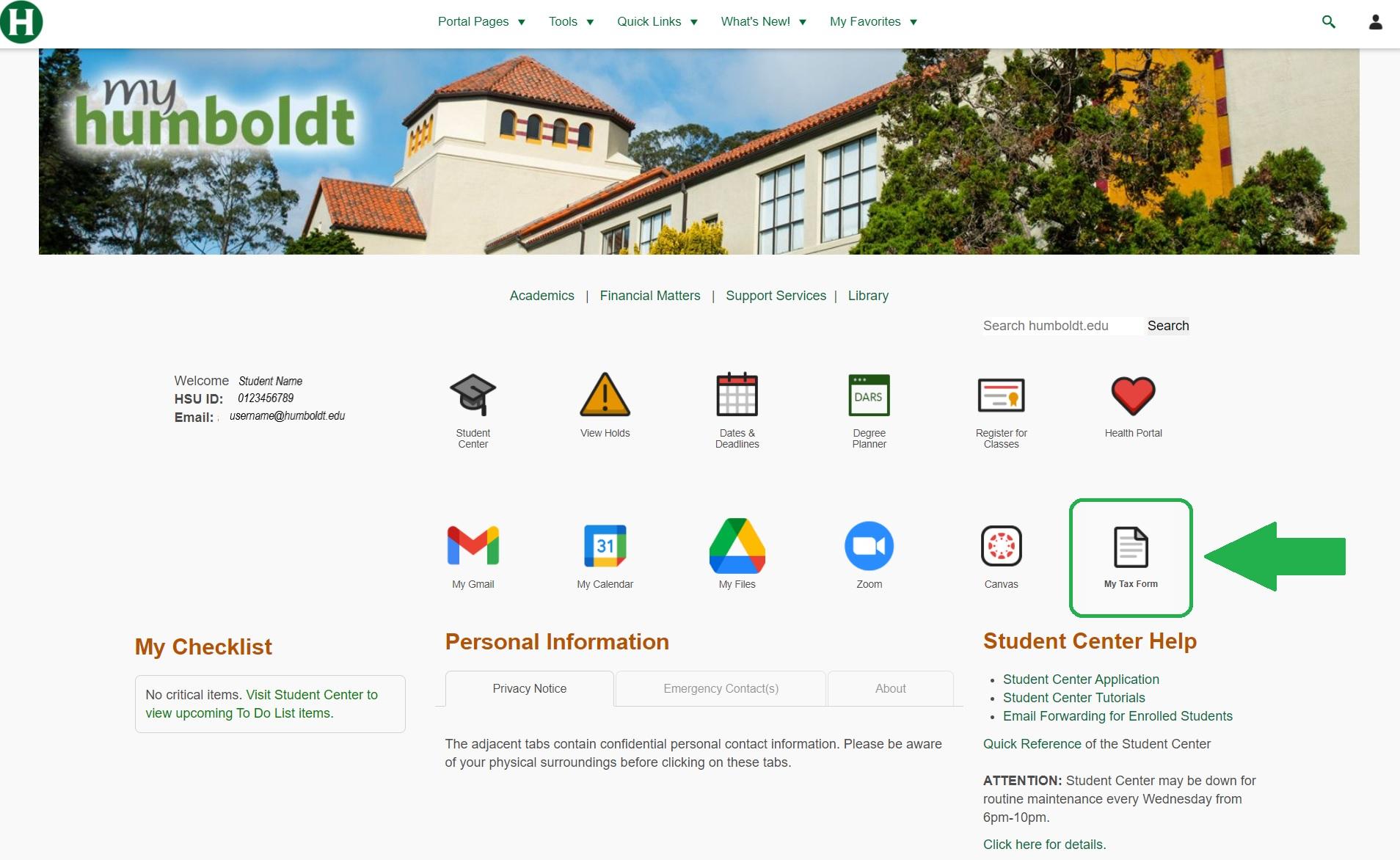

Attention: The Electronic 1098-T Tuition Statement for the 2023 calendar year is now available to view and print located on your MyHumboldt portal

What is Form 1098-T?

IRS Form 1098-T, Tuition Statement provides information from educational institutions to students that may be of use in determining a student's eligibility for two tax credits, the American Opportunity Credit and the Lifetime Learning Credit. This form can also provide information for other Tuition and Fees Deductions. However, the enrollment information by itself does not establish eligibility for either credit or deduction. The information being reported to the IRS verifies your enrollment concerning certain eligibility criteria.

Important Information Regarding your 1098-T

When figuring out an education credit or the tuition and fees deduction, use only the amounts you paid and are deemed to have paid during the tax year for qualified education expenses. In most cases, the student should receive Form 1098-T from the eligible educational institution by January 31. The Form 1098-T should give you other information for that institution, such as adjustments made for prior years, the amount of scholarships or grants, reimbursements, or refunds, and whether the student was enrolled at least half-time or was a graduate student.

Claiming Education Credits on Your Individual Tax Return

You should use the information on Form 1098-T in conjunction with your own payment records to complete your individual tax return. If you have questions about how to compute an education tax credit, consult your tax professional or refer to IRS Publication 970.

For more information on eligibility rules, see:

- Tax Benefits for Education: Information Center

- Tax Benefits for Education (IRS Publication 970) [PDF]

- Education Tax Incentives Overview

Frequently Asked Questions: Form 1098T

Online 1098-T Forms

Students can print an electronic 1098T form from their Student Center. Select the "View 1098-T" link on the dropdown menu under Finances in their Student Center. You will need to Grant Consent to receive online access or print forms electronically. Detailed information about your qualifying charges & scholarship will also be available.

What fees are included in qualified educational expenses?

The following fees are included:

- Registration Fees

- Tuition Fee

- Materials, Services & Facilities Fee

- Instructionally Related Activities Fee (IRA)

- Student Body Association Fee

- Campus Union Fee

- Health Facilities Fee

- Student Involvement & Representation Fee

- Nonresident Tuition Fee

- Identification Card Fee

- Extended Education Registration Fees related to your degree program

- Miscellaneous Course Fees related to your degree program

What fees are not included in qualified educational expenses?

The following fees and/or categories of expenses are not included in qualified expenses:

- Other Fees

- Housing and Dining

- Parking

- Health Services Fee

- Administrative fees, late fees, fines

- User fees such as for musical instruments and theater arts equipment use

- Transcripts

- Miscellaneous course fees not related to your degree program

I disagree with your classification of qualified and/or nonqualified fees. What should I do?

Consult your tax preparer.

How can I find out the details for the amounts shown on my 1098-T?

Detail transactions are available on your Student Center Account. Use the dropdown link under “Finances” to select the View 1098T hyperlink to find a listing of qualified expenses charged to your student account during the calendar year included in box 1 of the 1098-T Statement. Also included are financial aid awards, grants, and scholarships included in box 5 of your 1098-T Statement.

I paid an application fee of $70 but I don't see it listed on the supplemental form.

Application fees are not handled through student accounts and are therefore not included in the database used to provide this information. If you paid this fee it may be qualified. Consult your tax preparer.

Why aren't my short-term loan repayments listed?

Short-term loan proceeds used to pay University fees and charges are reflected in the amount for general payments. Short-term loan repayments are not included in the amounts reported.

I made payments to one or more of the organizations listed below. Why aren't these payments included in the detail?

- Cal Poly Humboldt Sponsored Program Foundation (HumboldtSPF)

- University Center

- Humboldt Bookstore

These organizations are separate corporations. Payments made to these entities are not reported by the University.

Was this information reported to the Internal Revenue Service?

Form 1098-T is reported to the IRS. The supplemental information is not; this dollar information is being provided to assist you in preparing your tax return (when determining your eligibility for the American Opportunity Credit and the Lifetime Learning Tax Credit).

What is considered half-time enrollment?

Enrollment in six or more units as of census date in any one term in the calendar year.

What is census date?

It is the date the University establishes its enrollment for the term. This occurs approximately 30 days after the first day of instruction.

I attended classes but did not receive a 1098-T Statement.

The University is not required to file a 1098-T Statement for:

- Students taking courses that do not offer credit towards a post-secondary degree on an academic transcript

- Students who are non-resident aliens

- Qualified tuition and related expenses that are waived or paid entirely with scholarships or financial aid

- Student fees paid by a Third Party Sponsor

I made payments on my student loans. Will you provide information on the amount of interest paid?

This information will be provided by your loan servicer on Form 1098-E.

More Information

For more info on the contents and use of the 1098-T forms, contact Student Financial Services at 707-826-4407.